The future of MEWP batteries

11 April 2022

Noble Zhang, C&D Trojan’s general manager for Asia Pacific, shares his view of electrification and battery technology in the access sector

Noble Zhang, general manager- Asia Pacific, C&D Trojan (Shanghai) Energy Technologies Co. (Photo: C&D Trojan)

Noble Zhang, general manager- Asia Pacific, C&D Trojan (Shanghai) Energy Technologies Co. (Photo: C&D Trojan)

Trojan Battery launched its first lithium-ion product late last year and has recently updated its lead acid line that combined will cover the requirements of today and tomorrow’s MEWP industry.

Known worldwide as a major supplier of batteries for the access industry Trojan Battery Company was acquired by C&D Technologies in 2019 and has since then combined its knowhow to create what it considers to be products that meet the requirements of the modern access sector.

The two brands now share a corporate leadership team, which oversees both entities across their operations, engineering, sales and marketing.

Where are C&D Trojan batteries made?

“Right now, we are one company with two brands, Trojan and C&D,” says Noble Zhang, general manager, Asia Pacific at C&D Trojan (Shanghai) Energy Technologies Co.

The company has two manufacturing plants and an R&D centre in China, with two of those three being in Shanghai, while the second manufacturing base is located in Pizhou, Jiangsu province.

The R&D centre and Shanghai plant supports both C&D and Trojan brands, while the Jiangsu Plant manufactures C&D products only.

The company also has manufacturing plants in the US and Mexico, which together cover its major markets of North America and APAC. However, the sales organisation is global and also covers South America and the EMEA.

The product focus of the two brands is quite different, with C&D producing batteries for stationary items and Trojan providing batteries to mobile tems like aerial platforms, low speed golf carts and floor equipment.

In the US Trojan’s market for aerial platforms is smaller than its own sales for other electric vehicles (EV), particularly golf carts. However, in China, AWPs are the company’s number one product.

Trojan AGM batteries used in aerial platforms. (Photo: C&D Trojan)

Trojan AGM batteries used in aerial platforms. (Photo: C&D Trojan)

Batteries for access platforms: the market

Having established itself in North America, Trojan’s major focus is now in Asia Pacific, and especially China.

“Trojan at the moment is quite US-based and most sales are in North America - China is another emerging market for our brand.”

A twist in the tale is that Trojan used to have the largest market share of batteries for aerial platforms in China.

However, explains Zhang, “Due to tariffs, that market share dropped. But we still see the market having a very high growth rate of 30% year-on-year, so that’s the most important market for us to grow in for the future.”

Putting that into figures, three years ago Trojan had 90% of the MEWP battery market share in China - today that has reduced to around 40%.

“We have the plan to take that market share back,” adds Zhang.

To address the tariff situation and bring production closer to its customers the company began manufacturing the Trojan brand in China in December last year. Previously, the batteries were imported from the US.

The company already offers two product types in China, the traditional flooded and Trojan AGM lines.

Of those two lead acid products, the new Trojan AGM has the most advanced technologies, with longer life, better capacity and are maintenance free. As such many customers are now shifting to this option.

Trojan’s flooded range. (Photo: C&D Trojan)

Trojan’s flooded range. (Photo: C&D Trojan)

“We are not spending any more resources to develop the flooded batteries, and we think in the future the market will be for AGM and lithium-ion.”

Future trends in the battery technology market

Both China and the US are driving towards electrification, and this is a trend that will accelerate over the next 20 to 30 years, Zhang points out.

The need for greater energy density in batteries means that lithium is set to be popular for off high highway equipment.

“So far, the best solution is the lithium battery, which compared to lead acid has a higher energy density and has a longer cycle life, which is positioning the lithium as a very good opportunity to replace some traditional lead acid battery applications, as well as some current [combustion] engine powered equipment.”

If, as it seems, the advantages of AGM will outweigh its older flooded sibling, what is the future for AGM versus the lithium option?

“I would say both technologies, AGM and lithium will exist long-term.”

Compared to lithium, AGM is safer and more stable than lithium, as well as being less expensive and more recyclable.

The advantages and disadvantages of Lithium-ion batteries

Zhang adds, “Lithium, of course, has its own advantages with long cycle life but still has its disadvantages; safety concerns, resource viability and the recycling are still issues waiting for us to solve.

“So, it depends on the future technology to see whether lithium will replace lead acid completely or not.”

Looking at those three disadvantages of lithium individually, Zhang adds, “From the technology side everything [in a lithium battery] we can recycle.

“It’s not really about recycling, it’s about making recycling safe and how to make the battery safe. Right now we are still learning how to contain the fire issue - we still need to understand more.”

On the availability of lithium, Zhang explains, “I still think this is the biggest constraint right now and for their future, because if the demand is for lithium to be used across the automotive industry, it requires huge resources, and based on current data it’s really hard to make that industry sustainable.”

Therefore, adds Zhang, something will need to change to make lithium viable in the very long-term.

“Basically, in my opinion, the lithium battery can currently be used as a solution for electrification but in the future we do require some new battery technology to replace lithium.”

Hydrogen is an option that we often hear about in the industry but will not be the solution for the vast majority of electric aerial platforms, says Zhang.

“It’s a solution that will be applied to the higher powered equipment. If we need a higher-powered lift then maybe we need a hydrogen fuel cell, but for smaller powered access the lithium battery still has a bigger opportunity in the segment.”

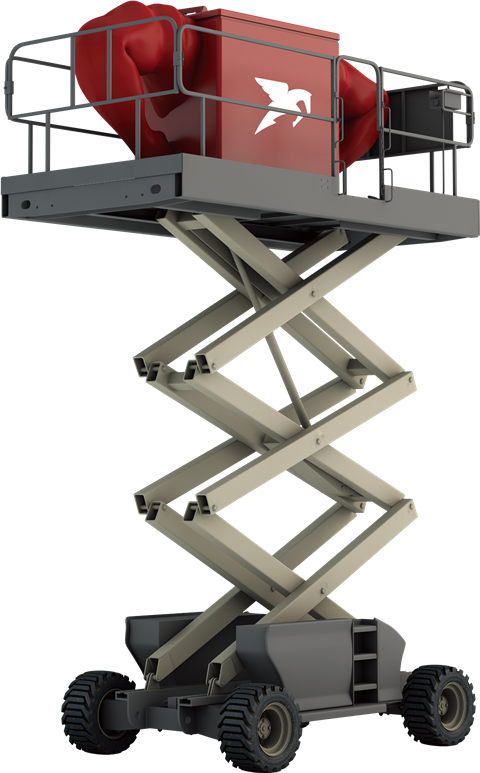

(Photo: C&D Trojan)

(Photo: C&D Trojan)

Carbon emission goals

Now that Trojan has stepped into the competitive lithium market in North America, what has been the market’s reaction to its first product?

Zhang explains, “We have got good feedback from the market and customers and it’s started to do very well, and definitely will take market share from our traditional flooded batteries.”

As Zhang repeats, lithium is on the increase and so too is the AGM solution in North America. “So, these two products are not competing right now but in two or three years’ time, they may be.

“In China we are looking at the same time frame, but because China right now is changing quite fast, it may move faster to achieve that.”

This growth will be underpinned by the Chinese government’s 30/60 goal, under which the country aims to achieve peak CO2 emissions by 2030 and hit carbon neutrality by 2060.

Whatever battery solution the wider industry comes up with next, Trojan has its future mapped out with its current product range. “We will focus on lead acid batteries and li-ion,” confirms Zhang.

Lithium-ion battery requirements

On the subject of Lithium, Trojan has seen the sharp rise in interest in this product type and at the end of 2021 launched its first lithium-ion battery in the US at the golf industry exhibition, the PGA Show.

While China is also a major market for lithium products, the company’s product for this market is still under development.

As Zhang explains, unlike the lead acid options it will be a very different product. “We do not have a product right now and this year we will make a plan to launch a lithium battery for China and Asia Pacific.”

“The two markets are quite different and the customer requirements are also quite different. We can’t just use the current lithium-ion batteries in China as we do in the US.

“The design and requirements, as well as the cost requirements are different, so we will have a different engineering solution.”

The reason for this, explains Zhang. “We see that the China lithium battery industry has more leading technology compared to the US side.”

This higher level of technology is found in many of the battery components, such as the battery management system (BMS).

“China has more understanding if this technology, and if we just copy the US design in China, it will look like we are going to an older generation of technology.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM