Is the access equipment supply chain experiencing another new normal?

09 September 2022

What are the solutions for a supply chain crisis that is set to continue? Access OEMs discuss the pros and cons of a changed production landscape.

OEMs across the world are battling the effects of supply chain constraints, and these issues have been made apparent in their recently published financial results.

For example, Manitou closed the first six months of its 2022 financial year with a 9% revenue rise to €1,057 million, compared to the same period last year.

However, the effects of supply chain issues and material pricing caused a drop in net income of 54% to €29.3 million, versus €64.2 million in the first half of 2021.

Michel Denis, president and CEO, Manitou Group. (Photo: Manitou)

Michel Denis, president and CEO, Manitou Group. (Photo: Manitou)

Michel Denis, Manitou’s CEO, said the company had seen an acceleration in production and deliveries, but, “Our supply chain continues to be disrupted by capacity, availability and shipping problems, which continues to encourage our customers to secure their future supplies by taking orders at a consistently high level, which is reflected in our order book.

“The sudden acceleration of inflation, particularly for steel, has led to a significant deterioration in margins. The measures put in place to deal with it are having an effect, but gradually, given the depth of our order book.”

Record backlogs

In its second quarter 2022 results, Terex reported a record-breaking backlog of $3.5 billion for its access equipment, an increase of 51% year-over-year.

An additional $600 million of orders deliverable are also on Genie’s books beyond the 12-month backlog window, bringing the company’s backlog total to $4.1 billion.

As John Garrison, Terex chairman of the board, explained during the company’s Q2 earnings conference call, the company has the capacity to produce more, but in this environment revenues cannot be forecasted based on customer demand, rather on the supply chain situation and the ability to produce based on available components.

The situation was compounded over the quarter by China’s zero Covid policy, which led to factory shutdowns impacting many China-based suppliers and adding further strain to global supply chain.

Garrison explains that Genie and Terex has approached the situation by minimising customer disruption through liaising closely with its supply base, with the process being escalated up to Garrison himself, who spends a lot of his time dealing with supply chain issues.

The company is also being transparent with its customers when implementing price increases.

As China-based Zoomlion Access points out, it is hydraulic and electronic components that are the most difficult to obtain.

The global pressures, including the pandemic and instability caused by the war in Ukraine that has stretched the supply cycle, means there is now a much greater demand in the international market.

Zoomlion, which has seen continued revenue growth in 2022, attended this year’s Empezando por el Concrete Show in São Paulo.

Zoomlion, which has seen continued revenue growth in 2022, attended this year’s Empezando por el Concrete Show in São Paulo.

For example, the rapid growth in China and other parts of the world, alongside the greater number of large-scale manufacturers, again based in China, means that more OEMs and their customers are chasing the same number of components.

“The supply chain of those components has achieved global distribution, and as a result, the supply, production scheduling, logistics and transportation of those components from factories at home and abroard have been greatly affected,” says a Zoomlion spokesperson.

Key component shortages

With there being no let-up in the demand for MEWPs, particularly in maturing markets like China, global instability in the supply of key components will continue.

“As a result, the competition for components from high-quality brands will become a new normal among manufacturers, and a stable and cost-competitive supply chain will be the focus of business operations,” says Zoomlion.

One solution, adds Zoomlion, to remove the bottleneck of material supply is by introducing more localised production and new technologies to aid the process.

“To cope with the increase in component costs, we adopt procurement strategies for different components to find out the potential of cost reduction, and cooperate with R&D to reduce the costs of materials and manufacturing.”

Stéphane Hubert, CSO at Haulotte explains the industry is facing a series of paradoxes thanks to growing order books combined with continuing and inconsistent material and component shortages – “The absolute mismatch.”

Lead times for some models are more than a year - a situation the sector has never experienced before.

And it is a situation that may continue through 2023, says Hubert, “The supply chain disruption is almost everywhere and has hit all kinds of component.”

On top of manufacturing issues comes logistics, due to a lack of containers on some shipping routes and increased road costs resulting from diesel price inflation.

All this has been caused by the incredible rebound in demand post Covid, combined with the crisis in Ukraine, resulting in “a dreadful clamp effect on components shortages, logistics, steel and energy costs which will likely lead to two full years of recovery before being back to a ‘regular’ situation,” says Hubert.

Therefore, the key words of production are ‘flexibility and adaptability’, with components secured months or even years in advance of forecasted production.

Compounding the problem is the inevitable rise in component costs, with some seeing markups 20 times, or even 40 times the prices of those in 2020.

Price rises

The only solution for OEMs is to pass on some of those added costs.

Hubert explains, “Since the beginning of the inflation curve, we made the decision to give the true picture of the situation to our customers and partners with an incremental pricing policy mirroring the impact on the other side of the value chain.

“Most of them granted and supported the approach, even though it sometimes required strong negotiation.”

Frank Nerenhausen, JLG president. (Photo: JLG)

Frank Nerenhausen, JLG president. (Photo: JLG)

Frank Nerenhausen, president of JLG Industries and executive vice president of parent company Oshkosh, remains positive about the situation but says there are several headwinds, including factors like labour shortages and inflationary pressures.

“We are aggressively pursuing multiple initiatives that address these challenges with the intention to establish a more agile and stable business model that supports a longer-term, sustainable recovery beyond 2022.”

Expectations are that the situation will continue to normalise over the next year, says Nerenhausen. However, the company is not resting on its laurels.

“We’ve learned that we need to become more geographically adaptive and agile, and as such are exploring nearshoring opportunities to regionalise our supply chains and push towards a sustained recovery.”

Regionalisation of the supply chain is a positive economic move, says Nerenhausen, as it is additional to current capabilities and will result in localised business and job growth.

“Our ultimate goal is to stabilise our supply chain without compromising product quality.”

How company’s are changing their recruitment tactics

Labour also remains in high demand. “Finding talent, retaining talent and keeping talent safe, while being as productive as possible, is a hurdle nearly every business will need to overcome.

“Companies are rethinking how they attract and retain employees in today’s increasingly remote workplace.”

Holding all these elements together is a difficult balancing act. Nerenhausen adds, “Maintaining a high degree of customer satisfaction amid inflation, supply chain and labour challenges is something that manufacturers will need to focus on as we emerge from what some may refer to as the most chaotic period in our industry’s history.”

Part of JLG’s solution is a strong customer focus, while shifting the company into the future.

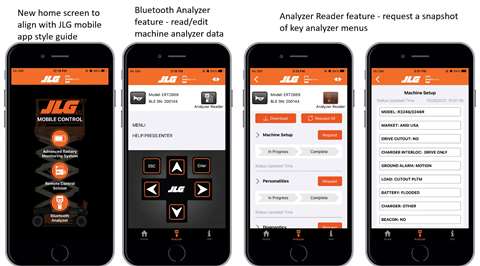

JLG’s Bluetooth Analyzer Reader. (Image: JLG)

JLG’s Bluetooth Analyzer Reader. (Image: JLG)

“We are investing in the development of connected and autonomous solutions that make it easier to do business with us and reduce the load/gap caused by today’s labour shortage.”

Malcolm Early, VP of marketing at Skyjack is in agreement on all the basic principles.

“The post-covid situation represents one of the most challenging environments the access manufacturing business has seen in decades,” he says.

“During Covid we thought we were in unprecedented times, yet two years on we still see daily challenges that keep on coming.”

Another, more recently apparent factor is the geo-political events such those in Ukraine, energy surcharges, China’s zero Covid policy with its associated lockdowns; and conflict in Sri Lanka – an important supplier of the industries’ tyres.

“The current reality is that things are not predictable or foreseeable. The only thing that we can confirm is a need for flexibility and change.

“At a high level, the experience is driving a look to consider more localised supply chain structures.”

While, Early confirms that all commodity groups are affected by the supply chain issue, he draws out engines as a specific example.

Early adds, “Another component experiencing delays is the well documented semi-conductor issue.

“These are more and more a part of our product today and this has negatively affected the supply of control modules.”

As previously explained, and as the industry emerges from the pandemic, the rental sector has strengthened, leading to increased orders.

“With two or more years of [Covid] restrictions increasing fleet age, the industry has a substantial demand for product.

“The current supply and demand equation means that fulfilling that demand is more challenging and may take more time. Today we are encouraging customers to plan to 2023 and beyond.”

Whether it be availability, logistics, or labour, all these issues come with significant cost increases.

“We have always tried to limit the ‘pass-on’ to our customers,” adds Early, “But in today’s environment it is just not practical. While we have made increases in our pricing, it far from covers the increased costs we face.”

“In the meantime, we look at increasing capacity and our manufacturing footprint with an ‘in the market for the market, approach’.”

Earlier this year Sinoboom marked the first units to roll off the production line at its new factory in Poland. (Photo: Sinoboom)

Earlier this year Sinoboom marked the first units to roll off the production line at its new factory in Poland. (Photo: Sinoboom)

European supply chain conditions

Sinoboom believes the situation might improve from mid-2023 but that plenty of challenges lie in the wake of these ongoing problems.

The company also points to diesel engines as a major issue, particularly those from Europe.

“EU-made diesel engines are one of the most difficult components to get,” says the company.

Pre-ordering components earlier than in ordinary years to counteract the challenges is one solution that helps reduce delivery times, but they have to be based on the industry’s and Sinbooom’s sales forecasts and trends.

However when it comes to supply chain issues, the Chinese manufacturers have been affected less, says Sinoboom.

“For global leading companies the backlog is huge, but for China-based manufacturer facilities and OEMs there was not so much impact.”

However, that is counteracted by the delivery conundrum. “For customers, shipping costs occupy too much of a share of overall costs compared with 2019 and before.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM