North American rental industry expects new ‘normal’ in 2024

15 November 2023

In 2021, the North American rental companies were nearly unanimous in being ‘up,’ but two years later, the latest economic forecast from the American Rental Association is predicting what ARA VP Josh Nickell calls a ‘normalization,’ a return to more moderate growth. Here’s what he has to say about what to expect in 2024 and beyond.

Josh Nickell, vice president of equipment rental, American Rental Association (ARA)

Josh Nickell, vice president of equipment rental, American Rental Association (ARA)

Equipment rental in North America is predicted to “normalize” going into 2024, according to Josh Nickell, vice president of equipment rental for the American Rental Association (ARA).

“Rental is going back to ‘normal,’ but normal means that strategy matters again - geography matters, fleet mix matters, customer type matters,” Nickell said. “In late 2020 to 2022, you just showed up with equipment and you made money.

“Everybody was breaking records, from the national rental chains to the smallest rental companies; everybody was having record years, and everybody was raising prices. The conversation was, ‘How much are you up?’ And now, the conversation is changing to ‘What’s my market like?’”

Nickell stressed this shouldn’t be taken as a pessimistic viewpoint. It’s simply coming back down to Earth from unprecedented circumstances during the time of Covid. Rental companies are still seeing growth, but at a more moderate level.

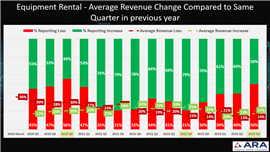

“People might say, ‘We’re only up 9% this year,’ instead of the 15% they expected,” he said, noting many companies that are feeling the reality check are still seeing double-digit growth.

“The caveat to that is a lot of our members raised rates over the past year. If you factor out the rate increase, then some of those companies are flat, or maybe up just a little bit, which again isn’t bad. It’s just not the crazy over-performance that we’ve had for the last couple of years.”

Nickell said North American equipment rental saw 15.9% growth in 2022, followed by an estimated 12.3% in 2023 and 5.3% in 2024. While this is a downward trend, it still exceeds the performance of the overall U.S. economy.

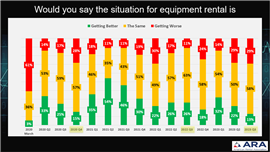

“When we talk to members about how they think things are going - whether business is better, the same, or getting worse - more and more people are saying it’s staying the same,” Nickell said. “To me, the picture isn’t negative, it’s normal. But it’s not rosy in the same way that it was a couple of years ago.”

Nickell said he looks back to the start of the pandemic and recalls how difficult it was to find a contractor in 2021, when everyone was starting remodeling projects because they were stuck at home. That demand has naturally evaporated.

“It’s the reverse of pent-up demand,” he explained. “Everybody finished their basement, everybody created that backyard oasis they always wanted. They’re not going to do it again this year,

especially with the housing market as it is.”

With interest rates twice what they were two years ago, many consumers are not moving, particularly if they just invested heavily in home remodeling. This trend is serving to further cool things off in DIY and small contractor rentals.

On the flip side, large international contractors are not slowing down. “We keep hearing about mega projects, where you have millions of dollars of rental equipment out on one single job site for multiple years,” Nickell said. “Those job sites are great, but they’re for larger rental companies with larger fleets and a larger contractor. Same thing with infrastructure spending and government spending. That tends to slant toward the larger contractors and the larger, either regional or national rental companies.”

This long-standing dichotomy between smaller, independent rental companies and the large, national chains illustrates the point about why strategy matters, Nickell said.

“A couple of years ago, you bought it if you could get a hold of it,” Nickell said of fleet purchasing. “Now it’s, ‘Should I buy that piece of equipment, does it make sense for my company?

Should we expand into that category? How do we lean into the categories or customer types that are doing well? And how do we decrease our dependence on the categories and customers that aren’t doing as well? How do we expand our business more effectively and more efficiently?’ I think all of those things are much more important again.”

Driven by data and analytics

It’s hard to go a day without hearing about a new platform that streamlines a process or a task, or prescribes a course of action for today’s rental business owner. But not everyone is fully up to speed yet.

“This speaks to the whole construction industry, which has traditionally been run on intuition. We still don’t use enough data and analytics,” Nickell said. “Some of our members are certainly trying to do that, and it’s an industry that is ripe for more of those types of data-driven decisions. But it’s still not the way that the average North American rental company, or the average construction company, is making a lot of their decisions.”

Nickell said analytics matter more than ever, however, particularly now that the frenzy of the pandemic era has drawn to a close.

“Companies need to be running their reports for dollar and time utilization. It’s not just a free-for-all, buy-everything atmosphere anymore,” he said, adding, “High interest rates are not bad for rental. Uncertainty is not bad for rental. Nobody wants to pay higher interest rates, but when a contractor is dealing with uncertainty and high interest rates, they tend to rent, and that drives rental penetration.”

Rental penetration expected to hit record high

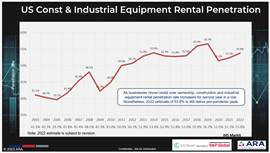

The relationship between uncertainty and rental penetration is not a straight line, however.

“Any time there’s a shock to the system, like in 2008 or during Covid, we typically see a huge initial drop in rental penetration,” Nickell explained. “Say you’re a construction company with a mixed fleet of owned and rented equipment, and suddenly, things slow down. What fleet disappears first?

“Contractors don’t sell their owned equipment immediately, they stop renting. But the next time they need equipment, they tend to rent vs. buy. Rental penetration then recovers and typically exceeds the previous drop.”

Evidence for this theory was seen at the start of Covid, when ARA’s Rental Penetration Index dipped severely from 56.7% in 2019 to 51.5% the following year. Estimates for this year, however, show it creeping back up to potentially record highs.

“I wouldn’t be surprised if it’s over 2019 levels at the end of this year,” Nickell said, noting rental penetration stood at 53.8% in 2022.

Furthering the case for deepening rental penetration is a generation of decision makers who grew up in the sharing economy.

“They grew up with AirBnB and Uber, they get the idea of access versus ownership,” Nickell said. “We have nice tailwinds that will continue to support the industry. It’s just that we need to be strategic again.”

He added, “Over the past couple of years, it was ‘Can you do it, can you buy it?’ Now it’s about making data-driven decisions, talking to customers about what equipment they need and thinking about new categories you can grow into,” he said.

“The companies that are really going to stand out from here are those that offer great customer service, have a great digital presence, and make strategic, analytically driven fleet decisions.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM